ASSETS MANAGEMENT

WallStreet Trades has a long track record of managing the complexities of assets.

INSTITUTIONAL MANAGEMENT

WEALTH MANAGEMENT

WHAT WE DO

OUR SERVICES

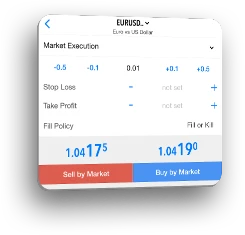

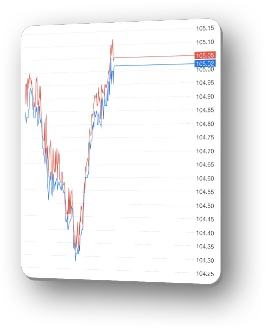

Foreign Exchange

WallStreet Trades finance offers a broad array of professional services and access to the global

foreign exchange markets for commercial and institutional clients.

Read more

...

REAL ESTATE

As one of the world's largest investors in real estate, we own and operate iconic

properties in the world's most dynamic markets.

Read more

...

Infrastructure

We are one of the world's largest infrastructure investors, owning and operating assets

across the utilities, transport and energy.

Read more

...

Fixed Income

We meet our investor's needs by offering a broad fixed income solution set and targeted

global market intelligence.

Read more

...

Stock

Stock trading involves buying and selling shares in companies in an effort to make money on daily

changes in price. Traders watch the short-term price fluctuations of these stocks closely and

then try to buy low and sell high.

Read more

...

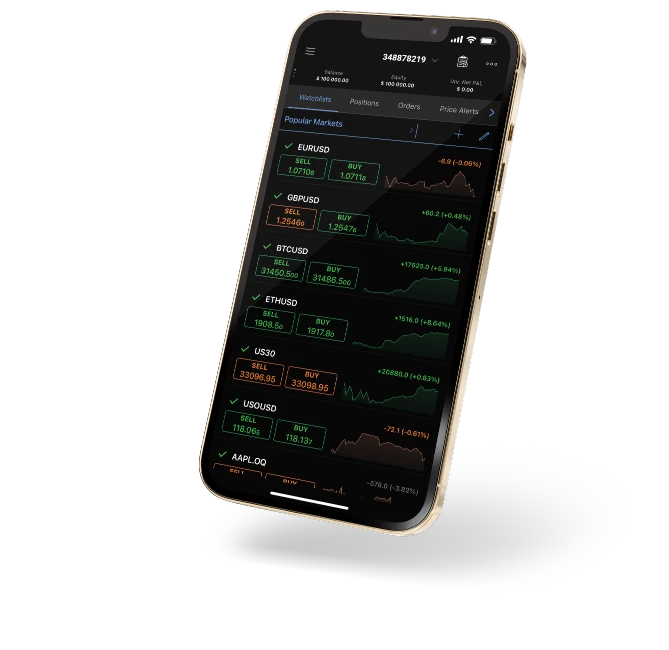

Options Copy trading

With over 500+ registered and regulated traders on WallStreet Trades, you get the liberty to beat

the

PDT and day trading requirements by getting started with our copy trading tool below the

$25k minimum requirement, get a more advanced view of the Market data Center, more enhanced

pricing and Mirror your desired/ dream expert on the best linked platform like Thinkorswim,

Webull, Robinhood.

At WallStreet Trades we thrive to bring you the modern trading experience.

Read more

...

LIQUIDITY PROVIDERS

MultiCopy Trade Group currently has a variety of liquidity providers, including but not limited to:

How to trade options in four steps

* Investment objectives. - This usually includes income, growth, capital preservation or speculation.

* Trading experience. - The broker will want to know your knowledge of investing, how long you’ve been trading stocks or options, how many trades you make per year and the size of your trades.

* Personal financial information. - Have on hand your liquid net worth (or investments easily sold for cash), annual income, total net worth and employment information.

* The types of options you want to trade. - For instance, calls, puts or spreads. And whether they are covered or naked. The seller or writer of options has an obligation to deliver the underlying stock if the option is exercised. If the writer also owns the underlying stock, the option position is covered. If the option position is left unprotected, it's naked.

Options trading

Options trading is when you buy or sell an underlying asset at a pre-negotiated price by a certain future date.

Trading stock options can be complex — even more so than stock trading. When you buy a stock, you just decide how many shares you want, and your broker fills the order at the prevailing market price or a limit price you set. Options trading requires an understanding of advanced strategies, and the process for opening an options trading account includes a few more steps than opening a typical investment account.

In 2022, the stock market has seen its share of highs and lows amid concerns about inflation, Russia's invasion of Ukraine and rising oil prices. When the market is volatile, options trading often increases, says Randy Frederick, managing director of trading and derivatives with the Schwab Center for Financial Research.

“You can use options to speculate and to gamble, but the reality is ... the best use of options is to protect your downside,” he says. "Options are one way to generate income when the markets aren’t going up.”

According to the Options Clearing Corporation, there were 939 million options contracts traded in March 2022, up 4.5% compared with March 2021. It was second-highest trading month on record.

TRADE OUR TOP PERFORMING PRODUCTS

WHO WE ARE

Welcome to WallStreet Trades

We begin by getting a deep understanding of your personal situation, goals

and needs.

WallStreet Trades Finance uses this information in our top-down investment process to first determine

the mix of Alternative funds, fixed income, cash or other securities that maximizes the

likelihood of reaching your financial goals.

We believe this decision has the

biggest impact on your returns over time. From there, we emphasise parts of the market we

believe will perform best, such as different countries and assets market sectors. Finally,

we analyze individual stocks and other securities and select those we believe will perform

best. We believe this active, flexible approach to portfolio management enables us to

capitalize on global investing opportunities and help you achieve your financial goals.

Investment Strategy

We seek out business teams with the coherence and expertise to develop a project capable of reaping long-term financial returns, which has positioned us as a firm with reliable investment expertise and dependable profitability.

Responsible Investing

At WallStreet Trades Finance we consider environmental, social and governance (ESG) issues throughout

the investment decision-making process and life-cycle. We believe that robust and

well-implemented ESG policies and practices contribute directly to the long-term success and

sustainability of our portfolio companies. Implemented effectively, they help us to protect

and enhance reputation and financial performance whilst creating stronger, more valuable

companies which can create benefits for all stakeholders: from employees to customers,

suppliers to shareholders, and the wider community at large.

We review our approach to ESG regularly to ensure that it continues to reflect best

practice.

Professional Portfolio Management

WallStreet Trades believes portfolio management is far more than just buying stocks and bonds and hoping they do well. We combine a tested "top-down" investment approach with personalized planning to build a portfolio tailored to your long-term financial goals. Our proven approach has attracted over $649 billion* from a global base of individual and institutional clients.

A philosophy rooted in the pursuit of alpha

Our clients rely on us to deliver performance alpha consistent with their specific objectives, taking into account both the level of return and the amount and type of risk taken to achieve it. In our experience, the best way to deliver true alpha is through fundamental, bottom-up research and disciplined portfolio construction, leveraging the skills of our highly experienced investment teams.

A focus on long-term, risk-adjusted returns

Our teams understand the importance of pursuing outcomes with superior risk/return characteristics. This focus is embedded in each step of the investment process.

High-conviction, risk-aware portfolios

Our focus on proprietary, security-level research allows us to build high-conviction, differentiated portfolios. Our risk management processes provide valuable insight to help our teams understand potential outcomes.

Specialized experience

Our equity teams are led by industry veterans—many with decades of experience managing their respective strategies—who work tirelessly to implement investment processes that can endure through changing markets.

Research driven

In an environment defined by uncertainty, the role that independent, bottom-up research and analysis plays in the investment process becomes ever more critical. Our structure fosters a research environment characterized by focused investment teams and embedded analysts with the ability to take advantage of our global reach.

Proprietary research

Original research is the cornerstone of effective investment processes. We pride ourselves on conducting bottom-up, independent research to generate unique company insight.

Global connectivity

We’re proud of our collaborative culture. It’s evident in the way we share our work across investment teams and asset classes—from formal collaboration to informal engagements, our research efforts are truly global. We harness all of our intellectual capital for the benefit of our clients.

Engaged debate

Our culture actively promotes a diversity of views. Open exchanges of ideas enables our teams to refine their investment theses and bring us closer to identifying the best investment ideas.

Multidimensional risk management

WallStreet Trades risk management is at the heart of everything we do. It starts with clearly defined and transparently communicated investment processes, includes formal ESG analysis with the support of dedicated specialists, and continues with ongoing multiple levels of portfolio and operational oversight. The goal is for our portfolio teams to take risk in alignment with client expectations.

CORPORATE PLAN

40% - 45% PIPS Get Started- minimum:$50,000

- maximum:UNLIMITED

- 10% Trade Commission

- 24/7 active support

ULTIMATE PLAN

35% - 40% PIPS Get Started- minimum:$20,000

- maximum:$49,999

- 10% Trade Commission

- 24/7 active support

PREMIUM PLAN

30% - 35% PIPS Get Started- minimum:$10,000

- maximum:$19,999

- 10% Trade Commission

- 24/7 active support

MASTER PLAN

25% - 30% PIPS Get Started- minimum:$5,000

- maximum:$9,999

- 10% Trade Commission

- 24/7 active support

STANDARD PLAN

20% - 25% PIPS Get Started- minimum:$3,000

- maximum:$4,999

- 10% Trade Commission

- 24/7 active support

CORPORATE PLAN

70% - 80% PIPS Get Started- minimum:$100,000

- maximum:UNLIMITED

- 10% Trade Commission

- 24/7 active support

ULTIMATE PLAN

60% - 70% PIPS Get Started- minimum:$50,000

- maximum:$99,999

- 10% Trade Commission

- 24/7 active support

PREMIUM PLAN

50% - 60% PIPS Get Started- minimum:$20,000

- maximum:$49,999

- 10% Trade Commission

- 24/7 active support

MASTER PLUS PLAN

40% - 45% PIPS Get Started- minimum:$10,000

- maximum:$19,999

- 10% Trade Commission

- 24/7 active support

STANDARD PLAN

30% - 40% PIPS Get Started- minimum:$1,000

- maximum:$9,999

- 10% Trade Commission

- 24/7 active support

ULTIMATE PLAN

200% PIPS Get Started- minimum:$150,000

- maximum:UNLIMITED

- 10% Trade Commission

- 24/7 active support

STARTER PLAN

100% - 124% PIPS Get Started- minimum:$50,000

- maximum:$99,999

- 10% Trade Commission

- 24/7 active support

PREMIUM PLAN

150% PIPS Get Started- minimum:$100,000

- maximum:$149,999

- 10% Trade Commission

- 24/7 active support

Clear investment processes

Our transparent investment processes detail how each investment team identifies and implements investment opportunities and the risk/return profile to be expected. We believe that strict adherence to these guidelines is one of the most effective forms of risk management.

ESG integration

As a signatory of the United Nations-supported Principles for Responsible Investment (UN PRI) initiative, we're committed to investing responsibly and supported by a global team of dedicated ESG specialists whose recommendations help shape the investment process.

Robust oversight

Portfolio risk management is supplemented by our independent risk and quantitative analytics team—which partners with investment teams to measure behavioral biases and other risks but reports to senior investment management—and an operational risk management function that assesses risk across the complex.

Here to guide your next step.

Our advisors can get you closer to your dreams-showing you the right financial steps to take today and in the days to come. Here's what you can expect when you work with one: